Non-Fluorinated DWR Fiber Systems Market Expands Across APAC, Europe, USA, and Saudi Arabia with Sustainability Push

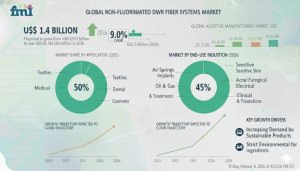

MD, UNITED STATES, February 6, 2026 /EINPresswire.com/ -- The global non-fluorinated DWR (durable water repellent) fiber systems market is entering a decisive execution phase, projected to grow from USD 1.4 billion in 2026 to USD 3.3 billion by 2036, according to a new forecast by Future Market Insights (FMI). This expansion reflects a strong 9.0% CAGR, driven by tightening PFAS regulations, evolving certification requirements, and accelerated phase-out of fluorinated chemistries across apparel, technical textiles, and regulated end uses.

Non-fluorinated DWR fiber systems are no longer being evaluated as experimental alternatives. Manufacturers are increasingly treating them as mandatory production inputs, as regulatory enforcement continues to erode the commercial viability of fluorinated technologies. Adoption is now being shaped by durability, processing stability, and compatibility with existing manufacturing lines, marking a transition from pilot-stage trials to scaled commercial deployment.

Regulatory Enforcement Reshapes Market Adoption

The primary growth catalyst for non-fluorinated DWR fiber systems is the rapid tightening of chemical governance and certification protocols. Updates to OEKO-TEX Standard 100 and STeP during 2024–2025 have increased scrutiny on PFAS presence at both formulation and residual levels, making long-term reliance on fluorinated DWR systems increasingly incompatible with certification renewal.

For fiber producers, mills, and garment manufacturers, this shift has transformed non-fluorinated DWR from an optional sustainability initiative into a baseline compliance requirement for maintaining approved supplier status. Brand-level sourcing mandates and retailer-led chemical governance frameworks are further compressing reformulation timelines and accelerating market conversion.

Execution-Driven Commercialization and Operational Integration

The market has entered an execution-oriented phase, where non-fluorinated DWR systems are being deployed as engineered performance platforms rather than transitional compromises. Evaluation criteria have expanded beyond peak water repellency to include wash durability, abrasion resistance, batch-to-batch consistency, and line compatibility.

Textile manufacturers increasingly favor solutions that can be deployed on existing finishing equipment without requiring process redesigns or capital expenditure. This emphasis on operational practicality reflects a maturing commercialization landscape, in which ease of integration and certification continuity are prioritized over marginal performance advantages.

Certification and Brand Governance Accelerate Conversion

Brand-level chemical governance has emerged as a critical accelerant. In 2024, several leading apparel and outdoor brands expanded internal policies to classify PFAS exposure as a material operational risk, directly linking DWR chemistry selection to supplier qualification and contract renewal.

These policies have translated into procurement mandates requiring non-fluorinated DWR compatibility at the yarn, fabric, and finished-garment levels, reducing tolerance for transitional fluorinated systems. As a result, reformulation is being driven as much by sourcing risk management as by regulatory timelines.

Performance Maturation Supports Scaled Adoption

Performance constraints that historically limited adoption are weakening as non-fluorinated systems mature. By late 2024, multiple non-fluorinated DWR fiber systems had cleared internal buyer benchmarks for spray rating retention, multi-wash durability, and abrasion resistance, allowing procurement decisions to shift away from technical feasibility concerns.

Commercial evaluations are now focused on scalability, cost predictability, and operational yield, signaling that non-fluorinated DWR systems have moved from experimental qualification into repeat-order procurement. This maturation is enabling broader deployment across large-volume apparel and technical textile programs.

Polyester and Paraffin/Wax Platforms Lead Adoption

Paraffin and wax-based chemistry platforms account for approximately 34% of the chemistry mix, reflecting their ability to deliver practical water repellency while aligning with certification and processing requirements. These platforms are particularly suited to high-throughput finishing operations where predictable processing behavior and consistent line outcomes are prioritized.

Polyester fibers represent around 37% of the primary fiber base, as polyester dominates performance textile substrates where DWR finishing is most frequently specified at scale. Regulatory enforcement timelines, including state-level PFAS restrictions, are accelerating conversion activity on polyester production lines first, reinforcing polyester’s role as the main substrate for non-fluorinated DWR system scaling.

Outdoor and Sportswear Remain Core Demand Centers

Outdoor and sportswear applications account for roughly 37% of total demand, reflecting high consumer visibility, frequent third-party material compliance requirements, and retailer-driven chemical policies. This segment exhibits the lowest tolerance for regulatory uncertainty, creating early and concentrated demand for scalable non-fluorinated DWR fiber systems.

Public brand commitments to PFAS-free outerwear and waterproofing have increased urgency for mills and finishers supplying these programs, amplifying demand for compliant, production-ready non-fluorinated DWR platforms.

Subscribe for Year-Round Insights → Stay ahead with quarterly and annual data updates: https://www.futuremarketinsights.com/reports/brochure/rep-gb-31860

Request for Sample Report | Customize Report |purchase Full Report -https://www.futuremarketinsights.com/reports/sample/rep-gb-31860

Key Regional Growth Markets

China and the United States are emerging as primary adoption centers, supported by regulatory sequencing, export-oriented compliance strategies, and large-scale textile manufacturing bases. Europe, including the UK, is advancing adoption through alignment with EU-level PFAS restrictions and retailer-led chemical governance frameworks.

Competitive Landscape and Market Evolution

The non-fluorinated DWR fiber systems market is undergoing a structural shift toward a fully PFAS-free paradigm. Competitive advantage is increasingly defined by compliance certainty, operational reliability, and scalable performance rather than sustainability positioning alone.

Leading suppliers such as Archroma, RUDOLF, Pulcra Chemicals, HeiQ Materials, Tanatex, Huntsman Textile Effects, and CHT Germany are repositioning portfolios around traceability, regulatory readiness, and process-stable non-fluorinated platforms.

As PFAS-free chemistry becomes a baseline requirement rather than a differentiator, pricing power is compressing and competition is shifting toward cost efficiency, performance completeness, and verifiable low-risk compliance across global textile supply chains.

\ Explore More Related Studies Published by FMI Research:

Battery Powered Surgical Drill Market-https://www.futuremarketinsights.com/reports/battery-powered-surgical-drill-market

Cytotoxic Chemotherapy Market-https://www.futuremarketinsights.com/reports/cytotoxic-chemotherapy-market

Targeted Oncology Biologics Market-https://www.futuremarketinsights.com/reports/targeted-oncology-biologics-market

Chaperone-based Therapeutics Market-https://www.futuremarketinsights.com/reports/chaperone-based-therapeutics-market

Substrate Reduction Therapies Market-https://www.futuremarketinsights.com/reports/substrate-reduction-therapies-market

About Future Market Insights (FMI)

Future Market Insights, Inc. (FMI) is an ESOMAR-certified, ISO 9001:2015 market research and consulting organization, trusted by Fortune 500 clients and global enterprises. With operations in the U.S., UK, India, and Dubai, FMI provides data-backed insights and strategic intelligence across 30+ industries and 1200 markets worldwide.

Why FMI: Decisions that Change Outcomes- https://www.futuremarketinsights.com/why-fmi

Contact Us:

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware – 19713, USA

T: +1-347-918-3531

Website: https://www.futuremarketinsights.com

LinkedIn| Twitter| Blogs | YouTube

Have a specific Requirements and Need Assistant on Report Pricing or Limited Budget please contact us - sales@futuremarketinsights.com

Sudip Saha

Future Market Insights Inc.

+1 347-918-3531

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.